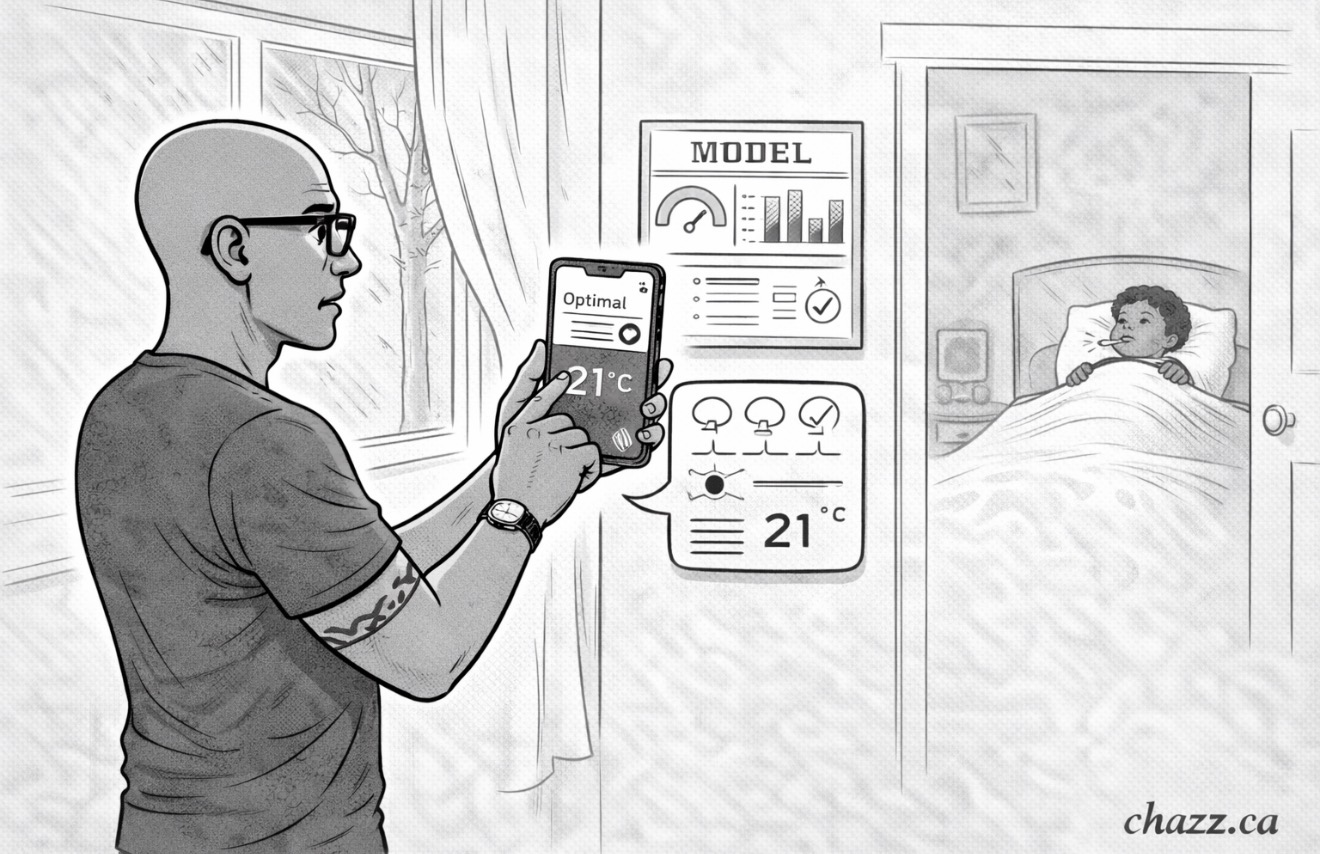

Last week I stood in my kitchen arguing with a smart home system that was convinced everything was fine. The house was cold. The thermostat said it was optimal. I tried explaining through an app that the system did not understand a drafty window, a sick child, and the fact that comfort is not the same thing as efficiency. The system kept insisting it was following the model. It was not wrong. It was just blind.

That small moment captures a much bigger issue we are all living with right now.

We have entered an era where automated systems make decisions at scale. Customer service lines route us through menus. Algorithms flag risks. Dashboards summarize reality into neat charts. The promise is speed and consistency. The cost is context.

In risk management, there is a concept called model risk. It refers to the danger of relying too heavily on a mathematical or digital representation of the world that simplifies reality too aggressively. Models are powerful, but they are not the world. They are guesses about the world, built on assumptions that may or may not hold when life gets messy.

The problem is not that models exist. The problem is that they are often treated as truth rather than tools.

Automated systems are excellent at pattern recognition. They excel when the future looks like the past and when inputs behave as expected. They struggle when something unusual happens. They struggle with nuance. They struggle with edge cases. Most importantly, they struggle with human factors that do not fit neatly into a dataset.

This is where the human premium shows up.

A human in the loop brings something that no system can fully replicate. Judgment. Context. Empathy. The ability to hear what is not being said and to notice when the numbers feel right but the situation feels wrong. Humans are not more efficient than machines. They are more adaptive.

True risk management is not about eliminating uncertainty. It is about navigating it. Automated systems optimize for known variables. Humans are better at sensing emerging ones. That difference matters when conditions change quickly or when the cost of being wrong is high.

For businesses, this is a strategic advantage, not a sentimental one. Organizations that rely solely on automation often look impressive until something breaks. When it does, there is no one who understands the why behind the decision, only the what. By contrast, organizations that preserve human judgment alongside data tend to recover faster. They can explain decisions. They can adjust assumptions. They can rebuild trust.

The same is true for individuals. A spreadsheet can show probabilities. It cannot understand priorities. An algorithm can rank options. It cannot understand trade offs rooted in values or lived experience. When people treat automated outputs as answers instead of inputs, they outsource responsibility along with judgment.

Efficiency is seductive. Optimization feels smart. But resilience comes from redundancy, humility, and the willingness to slow down when something does not quite fit the model.

The human premium is not about rejecting technology. It is about placing it correctly. Data should inform decisions, not replace them. Systems should support judgment, not override it. The goal is not to be perfectly optimized. The goal is to be robust when reality refuses to cooperate.

You May Like:

I am a Canadian insurance and investment professional and the President and Chief Executive Officer of Chazz Financial Inc. and Chazz Capital Assets. I write about leadership, markets, insurance, investing, and decision making, with a focus on how structure and incentives shape outcomes.

I hold a business degree and I am a Fellow of the Canadian Securities Institute (FCSI®), a Chartered Life Underwriter (CLU®), a Chartered Financial Planner®, a Certified Health Specialist and a Mutual Fund Investment Representative.

Leave a Reply